With regards to capital your home, you to proportions will not fit all the. And even though antique choices for example finance, domestic collateral credit lines (HELOCS), refinancing, and contrary mortgage loans could work really for most property owners, the fresh current go up away from loan choice including domestic equity buyers and other growing programs have really made it clear there is an evergrowing demand for other available choices. Learn more about alternative ways to get guarantee from your house, in order to build a far more advised choice.

Antique Possibilities: Benefits and drawbacks

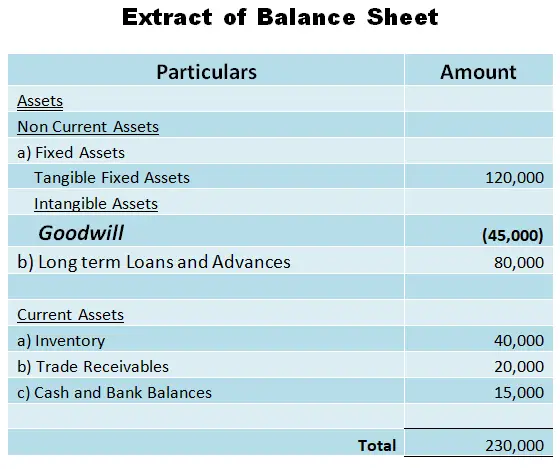

Funds, HELOCs, refinancing, and you will contrary mortgages can all be glamorous an effective way to make use of the newest guarantee you’ve collected of your property. However, you can find commonly as many cons and there’s experts – therefore it is crucial that you understand the pros and cons of every to learn as to why particular property owners are looking for financial support solutions. Understand the chart below so you’re able to rapidly evaluate loan options, after that continue reading for more details on for each and every.

Domestic Collateral Loans

A house guarantee financing the most prominent suggests one to property owners access its collateral. One can find pros, as well as a foreseeable monthly payment as a result of the loan’s fixed desire speed, in addition to undeniable fact that you’ll get new guarantee in one swelling share payment. Thus, a home security mortgage usually makes sense if you are looking so you can shelter the expense of a restoration investment or large you to definitely-out of debts. Also, their notice costs tends to be income tax-deductible while you are utilising the money for home improvements.

As to the reasons seek out property guarantee financing solution? A few explanations: Very first, you will have to pay off the mortgage as well as your own typical mortgage payments. Incase the borrowing from the bank is quicker-than-advanced (below 680), you might not additionally be acknowledged to own a home equity financing. Eventually, the application processes will be intrusive, troublesome, and you may taxing.

House Collateral Personal lines of credit (HELOC)

HELOCs, a familiar replacement for a house security financing, render quick and easy usage of finance should you need him or her. And while you typically you prefer a minimum credit score off 680 so you can qualify for good HELOC, it can actually make it easier to replace your get over the years. What’s more, you happen to be in a position to delight in taxation pros – write-offs as much as $a hundred,one hundred thousand. Since the it’s a personal line of credit, there is no interest due unless you take out currency, and you may sign up for around you would like until you hit the restriction.

But with this autonomy happens the opportunity of most personal debt. Instance, if you intend for action to settle credit cards with high interest rates, you might become accumulating more charge. So it actually happens so frequently it is known to loan providers since reloading .

Another biggest drawback that may remind property owners to seek an effective HELOC alternative is the imbalance and you can unpredictability which comes in addition to this solution, as variability inside prices may cause fluctuating costs. Your own lender may also frost the HELOC when – or decrease your borrowing limit – if there is a decline in your credit score or domestic worthy of.

Learn how well-known it is to have home owners as if you to make use of to possess mortgage brokers and you can HELOCs, in our 2021 Citizen Report.

Cash-aside Re-finance

You to replacement for a home equity mortgage is a funds-out re-finance. One of the largest perks of a finances-away re-finance is that you could safe a lower interest on the home loan, meaning that lower monthly payments plus dollars to fund almost every other expenses. Or, whenever you can build highest payments, a good refinance might be a sensible way to shorten the mortgage.

Without a doubt, refinancing features its own group of pressures. As the you may be basically settling your existing financial with a new that, you are stretching your financial schedule and you are clearly stuck with the same charges you handled the first time around: application, closing, and origination fees, term insurance, and perhaps an assessment.

Total, could spend ranging from two and you can half dozen percent of your own total number you use, according to certain lender. Even so-entitled no-cost refinances will be deceptive, since you will probably have a higher level to compensate. In case the amount you’re borrowing is greater than 80% of your house’s well worth, you’ll likely have to pay getting personal home loan insurance rates (PMI) .

Clearing the fresh obstacles away from application and you can qualification can result in dry ends for most property owners who have imperfections on their credit rating or whoever ratings merely are not sufficient; really loan providers need a credit rating with a minimum of 620. These are simply a few of the causes residents may find themselves seeking to an alternative choice to a cash-away re-finance.

Reverse Financial

Without monthly obligations, a reverse mortgage will be perfect for earlier people interested in more income throughout senior years; a current guess regarding the National Opposite Lenders Organization found you to definitely older persons had $seven.54 trillion tied inside real estate equity. Yet not, you are however responsible for the newest percentage off insurance rates and you can taxes, and want to remain in the home into the longevity of the mortgage. Contrary mortgage loans also have an age element 62+, hence laws it out as a viable selection for of numerous.

There is a lot to adopt when considering traditional and you may option an approach to accessibility your residence security. The second guide helps you browse for each and every choice even further.

Selecting a choice? Go into the House Security Money

A more recent replacement for house collateral funds was house equity investments. The great benefits of a house equity funding, particularly Hometap has the benefit of , otherwise a discussed admiration arrangement, are numerous. These buyers leave you near-quick access into the security you’ve made in your property when you look at the exchange having a portion of the future worth. At the end of the newest investment’s productive months (and this hinges on the firm), your accept the fresh financing by buying it which have discounts, refinancing, or promoting your home.

That have Hometap, as well as an easy and smooth app techniques and you will unique certification criteria which is will way more comprehensive than simply regarding lenders, you have one-point regarding get in touch with on investment sense. Probably the most important difference is the fact instead of such more conventional channels, there aren’t any monthly obligations otherwise desire to bother with to your most readily useful of home loan repayments, so you’re able to reach your monetary needs faster. If you find yourself seeking choice the way to get collateral from your home, working with a home guarantee buyer would-be value investigating.

Try an excellent Hometap Investment the proper family security mortgage alternative for your assets? Need our very own five-time quiz to determine.

I create our very own far better make sure everything for the this information is because the appropriate that one may since the newest day it is published, however, anything alter rapidly possibly. Hometap click for more info doesn’t recommend otherwise screen any linked other sites. Personal issues differ, very check with your very own financing, tax or lawyer to see which makes sense for your requirements.